The Evolution of Mail Surveys: From Traditional to Modern Approaches

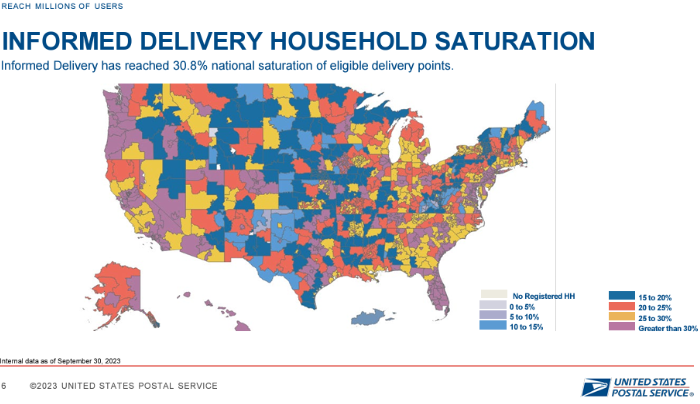

Informed Delivery is a great tool for residents to know what mail they have coming in, but do you know about the benefits this benefit provides to survey research...

Ranging from cash to prize drawings, incentives can take a wide variety of forms. The question should not be whether you use incentives, but which incentives will have the...

Explore all of the benefits technology has to offer for your paper survey projects, by incorporating online elements, such as QR codes, into your survey materials.

Explore the benefits of outsourcing your print and mailing project needs, to elevate your projects & client experience. From cost savings to expert guidance, we will guide you through...

In the world of Survey Research, there are a lot of options out there with an assortment of features to consider. One consideration is the type of reporting and...

Greetings & salutations from your neighborhood survey partners, DataForce Research here! As many of you are involved in survey research, one of the more common types of participant outreach...

Greetings, fellow researchers and valued partners in the public opinion research industry! DataForce Research here with another article close to heart for our research partners – Postage Rates vs...

Greetings & salutations from your neighborhood survey partners, DataForce Research here! If you are involved in survey research, the odds are high that you engage in mailing services...

Greetings & salutations from your neighborhood survey partners, DataForce, here! Like most of our clients, you are involved in survey research, and a large part of that is distributing...